Fixed Income securities will always import as user-defined securities. If there is a Morningstar security match, it will be mapped to the Morningstar security so that it has access to Morningstar information for analytical reports. The Use as Substitute field will be set to No and the Price Source will be set to Imported Price. Click here  for more information on how security mapping works. The Morningstar Bond Database does not have pricing, therefore, imported prices should be used.

for more information on how security mapping works. The Morningstar Bond Database does not have pricing, therefore, imported prices should be used.

Things to know about Fixed Income securities:

Par Value is usually 1 or 1000, depending on your custodian

Par Value can be 100 if the security is used in a manual account or imported via Excel

Note: If you plan to import the security from a custodian down the road, then you should find a way to have the Par Value equal to what it will when you import from the custodian. Otherwise, there will be incorrect performance and it will require a lot of manual work to fix.

Price is always around 100

The following topics are covered:

How market value for a Treasury Inflation-Protected Security (TIPS) is calculated

How market value for a Mortgage Backed Security is calculated

How Market Value for a Fixed Income or CD is Calculated

The formula for calculating the market value for Fixed Income or CD securities is below:

Market Value = Par Value x Price% x Price Factor x Shares

Using the example below, the market value would be calculated as: 1 x 100.8992% x 10,000 = $10,089.92

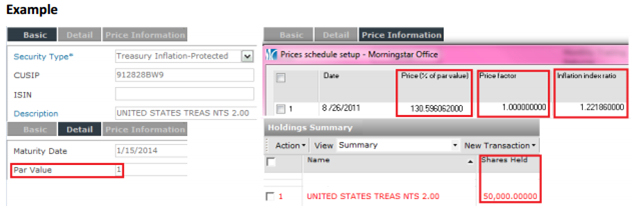

How Market Value for a Treasury Inflation Protected Security (TIPS) is Calculated

Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation. The principal for TIPS increases with inflation and decrease with deflation, as measured by the Consumer Price Index.

The formula for calculating the market value for Treasury Inflation-Protected Securities is below:

Market Value = Par Value x Price% x Price Factor x Inflation Index Ratio x Shares

Using the example below, the market value would be calculated as: 1 x 130.596062% x 1 x 1.22186 x 50,000 = $79,785.05

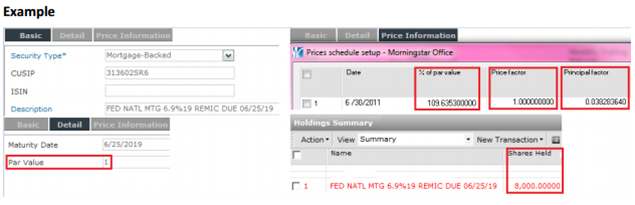

How Market Value for a Mortgage-backed Security is Calculated

Mortgage-backed securities (MBS) are debt obligations that represent claims to the cash flows from pools of mortgage loans, most commonly on residential property. The Principal Factor will decrease as mortgage loans are paid off.

The formula for calculating the market value for Mortgage-backed securities is below:

Market Value = Par Value x Price% x Price Factor x Principal Factor x Shares

Using the example below, the market value would be calculated as: 1 x 109.6353% x 1 x .038283640 x 8,000 = $335.78