The Spin-off Wizard is designed to help you adjust cost basis after a stock is spun off.

A spin-off occurs when a company creates another independent company from an existing part of the company by selling or distributing new shares to current shareholders. Spin-offs are often referred to as a distribution of shares. Spin-offs not only require a distribution ratio to determine the number of new shares to be received, but a New Cost Allocation % is required for the transferring of cost basis. This percent alters the per share cost basis of the original security and determines the per share cost basis of the new security.

Since your custodian may already generate transactions for spin-offs, a logical question is: Why should I bother using the Spin-off Wizard for something that already exists? The Spin-off Wizard is recommended for three reasons:

The transactions from your custodian will not adjust the cost basis for the original security, but the Spin-off Wizard will.

You can control the Cash in Lieu amount recorded for each transaction, and ensure your clients’ Cash account is updated correctly.

For a transactional account you imported via the Microsoft Excel - Transactions interface, the Spin-off Wizard will help keep these accounts updated.

Prior to running the spin-off wizard, you may need to delete transactions that have been imported through a custodian. These transactions are often flagged and located at the top of the Transactions blotter. You won’t need to use these transactions, since they will be re-created and accounted for by the selected wizard. Export the transactions pertaining to the corporate action to an Excel spreadsheet for reference later, and then delete those transactions. Note: If you already posted the transactions to your clients' accounts, export them to an Excel spreadsheet from the client's accounts, and then delete them from there.

The spin-off wizard can be launched from two areas of the system; either the Import Sources grid or the import blotter screen.

To facilitate the process of reconciling and posting spin-off transactions, Morningstar recommends using the Corporate Action wizard from the Corporate Actions Warehouse window from the import blotter screen as this will allow you to reconcile the date. The wizard can be used during your normal import process. Note: If the accounts were imported from Microsoft Excel, they cannot be reconciled; you can simply post the transactions to your account.

To access this feature from the main menu, click Import from the top toolbar.

From either the Import Sources grid, or the import blotter screen, click Corporate Action Warehouse from the top menu.

Morningstar Office stores information for many spin-offs and mergers in the Corporate Action Warehouse. If your spin-off is listed, you can use the information provided by Morningstar to generate the transactions.

Select the spin-off by placing a check in the box next to the Issuer Name, and then from the top menu, click Corporate Action Wizard. The wizard opens with known information about the spin-off pre-populated.

Continue through the wizard to create the transactions.

If your spin-off is not available in Office, or if you choose to manually enter the information for the spin-off, select Corporate Action Wizard from the top menu and the Select a wizard to run dialog opens.

Select Spin-off Wizard and click OK. The fields within the wizard are described below.

On the first screen you will select the Event type: Non-Taxable or Taxable. This will affect the transaction types used to create the Spin-off. Selecting Taxable will create Buy and Sell transactions, whereas selecting Non-Taxable will create Credit of Security and Debit of Security transactions.

Make your selection and click Next.

On this screen, you will enter the information for the original security, the date of the spin-off, and the new cost allocation.

In the Security Name or Symbol/CUSIP field, click the magnifying glass icon. The Find Securities dialog opens.

Select the security and click OK. You are returned to the spin-off wizard.

In the # of New Securities field, enter the number of securities resulting from the spin-off.

Click the Effective Date drop-down. A calendar appears. Select the date the spin-off takes effect.

Based on your date selection, the Cost Allocation Method defaults to the closing trading price issued on the trading date and the Fair Market Value Per share field is populated with the closing market price on the day before the spin-off. If a different cost allocation method is selected, the fair market value price must be researched and manually entered. Then, the new cost allocation must be recalculated (refer to the spreadsheet below) based on that price.

In the New Cost Allocation (%) field, enter the percentage of the cost allocated to the original security. If this is not provided or you need to recalculate the percentage, use the cost allocation calculator spreadsheet provided by Morningstar. Click here  for more information on cost basis for the original and new securities.

for more information on cost basis for the original and new securities.

Click Next.

On this screen, you will enter the information for the new security, the share distribution rate, and determine how fractional shares are handled.

In the Security Name or Symbol/CUSIP field, click the magnifying glass icon. The Find Securities dialog opens.

Select the security and click OK. You are returned to the spin-off wizard.

The New Cost Allocation (%) field is automatically populated based on the cost allocation allotted to the original share. If you are creating more than one new security, you will need to adjust this field to align with percentages allotted to each new security. Click here  for more information on cost basis for the original and new securities.

for more information on cost basis for the original and new securities.

In the Share Distribution Ratio field, enter the distribution ratio in decimal places. For example: If you are receiving 1 share of the New Security for every 2 shares of the Original Security you hold, you would enter .50 in this field.

In the Are you receiving cash in lieu of fractional shares? field, click the Yes or No radio button. Click here  for more information on cash in lieu transactions.

for more information on cash in lieu transactions.

If you selected Yes, in the Cash in Lieu Price field, enter the amount of cash received. If no amount, or 0 is entered, sell transactions will be generated on the Cash in Lieu blotter with a red warning. To correct the transactions, refer to the Cash in Lieu transactions you exported prior to deleting them to retrieve the Net Amount. Morningstar recommends updating the Net Amount column rather than the Price column to avoid rounding issues. If the price is added and the calculated Net Amount value (Number of Shares x Price) results in a value with more than two digits after the decimal (18.756 instead of 18.76), this could result in incorrect values in the Cash account. After entering the net amount in both the Sell and Deposit fields, click Save to have the system complete the transaction.

If you selected No, the option changes to Fractional Shares and you must select how you want to handle the fractional shares. If Fractions is selected, the system retains the exact number of whole and fractional shares created through the spin-off. If Dropped is selected, only whole shares are retained and the fractional shares are ignored. If Rounded is selected, and the fractional share is .50 or greater, the system rounds up to the next whole share; if less than .50, the system rounds down to the closest whole share.

Click Next.

Note: If a spin-off generates more than one new security, you will see another New Security page when you click Next. Otherwise, you are brought to the Select Which Portfolios page in the wizard.

On this screen, you will select the portfolios to which the spin-off transaction should be generated.

Click the Custodian drop-down and select the custodian from which you import portfolios.

The All portfolios radio button is selected by default.

If you do not want to select all portfolios, check the Select portfolios radio button and click the magnifying glass icon. The Find Accounts dialog opens.

Select the account(s) and click OK.

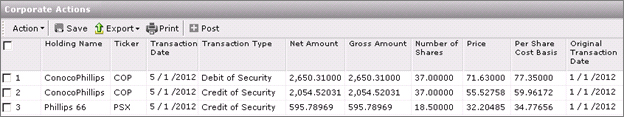

Click Next to generate the transactions. You are taken to the Corporate Actions Blotter where you can review the transactions.

See Also

See Also

Determining the Spin-off Cost Basis

FAQs for Spin-off Transactions